Self Finance vs Bank Lease for Tractor – Which Is Better in 2026?

Self Finance vs Bank Lease for Tractor is no longer a simple cash decision for farmers. With rising tractor prices, higher input costs, and increasing focus on mechanized farming, most farmers now face a critical question: Should you buy a tractor through self finance or opt for a bank lease?

Both options have advantages and limitations depending on farm size, income stability, subsidy access, and long-term planning. In 2026, banks, microfinance institutions, and government-supported leasing schemes have expanded aggressively, making the comparison even more important.

Understanding Tractor Purchase Options in 2026

Before comparing the two methods, it is essential to understand how tractor purchasing works today.

Tractor Market Reality in 2026

- Tractor prices have increased due to currency pressure and import costs

- Demand for fuel-efficient and mid-HP tractors has risen

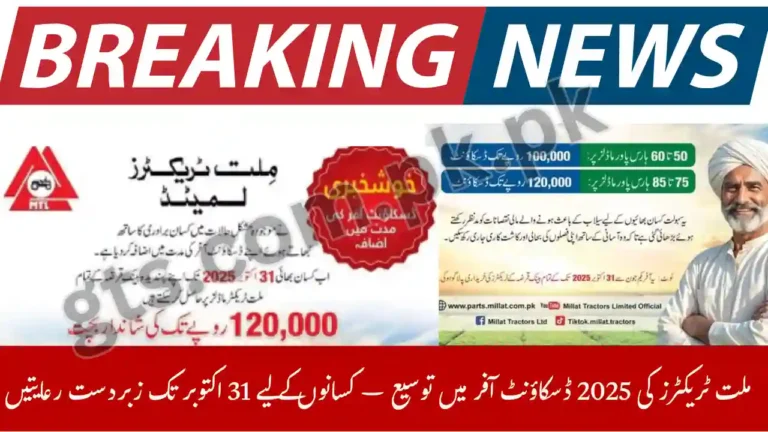

- Government subsidies exist but often require partial self-payment

- Banks have tightened documentation but improved installment flexibility

As a result, choosing the right financing method has become just as important as choosing the tractor model itself.

What Is Self Finance for Tractor Purchase?

Self finance means purchasing a tractor using your own funds, savings, or family resources without borrowing from a bank or leasing company.

How Self Finance Works

- Full payment is made upfront

- Tractor ownership is immediate and unconditional

- No bank involvement or installments

- No interest, markup, or leasing charges

This method has traditionally been preferred by large landowners and farmers with strong cash reserves.

Advantages of Self Finance Tractor Purchase

1. Zero Interest or Markup

The biggest advantage of self finance is no additional cost. You only pay the actual tractor price.

2. Full Ownership from Day One

The tractor is registered entirely in your name, with no bank lien or hypothecation.

3. No Monthly Installments

You avoid financial stress during low-income months, droughts, or crop failure seasons.

4. Faster Purchase Process

No documentation delays, bank approvals, or insurance restrictions.

5. Better Negotiation Power

Cash buyers often get:

- Dealer discounts

- Free implements

- Reduced registration charges

Disadvantages of Self Finance in 2026

1. Heavy Cash Requirement

Tractors in 2026 cost significantly more, making full cash payment difficult for small farmers.

2. Reduced Liquidity

Spending all savings on one machine can:

- Limit ability to buy seeds or fertilizer

- Reduce emergency funds

- Increase risk during poor crop seasons

3. Missed Investment Opportunities

Cash tied up in a tractor cannot be used for:

- Land leasing

- Tube wells

- Livestock expansion

What Is Bank Lease or Tractor Financing?

A bank lease (also called tractor financing) allows farmers to purchase a tractor by paying a down payment, while the remaining amount is paid in monthly or quarterly installments.

How Bank Leasing Works

- Farmer pays 20%–40% down payment

- Bank finances the remaining amount

- Tractor remains under bank lien until full payment

- Tenure ranges from 3 to 7 years

In 2026, most major banks offer tractor financing under agricultural credit programs.

Advantages of Bank Lease for Tractor in 2026

1. Low Initial Investment

Farmers can acquire a tractor without paying the full amount upfront.

2. Cash Flow Flexibility

Savings can be used for:

- Crop inputs

- Labor wages

- Fuel and maintenance

3. Access to Modern Tractors

Leasing enables farmers to:

- Buy higher HP models

- Upgrade to fuel-efficient tractors

- Use advanced attachments

4. Government-Linked Schemes

Some leasing programs in 2026 offer:

- Subsidized markup

- Grace periods

- Special rates for small farmers

5. Tax and Record Benefits

Financed tractors often come with:

- Proper documentation

- Insurance coverage

- Transparent financial records

Disadvantages of Bank Lease

1. Interest and Markup Cost

Total tractor cost increases due to:

- Bank interest

- Processing fees

- Insurance charges

2. Ownership Restrictions

Until the last installment is paid:

- Tractor cannot be sold

- Modifications require bank permission

3. Strict Documentation

Banks usually require:

- CNIC

- Land ownership proof

- Bank statements

- Guarantor in some cases

4. Risk of Default

Missed installments can result in:

- Penalties

- Tractor repossession

- Credit history damage

Self Finance vs Bank Lease – Cost Comparison in 2026

| Factor | Self Finance | Bank Lease |

|---|---|---|

| Upfront Payment | 100% | 20–40% |

| Interest | None | Yes |

| Ownership | Immediate | After full payment |

| Monthly Burden | None | Fixed installments |

| Risk Level | Low | Medium to High |

| Cash Flow | Tight | Flexible |

| Long-Term Cost | Lower | Higher |

Which Option Is Better for Small Farmers?

For small farmers, bank leasing is often the practical choice in 2026 because:

- Income is seasonal

- Cash reserves are limited

- Government schemes support financing

However, installment planning must match crop cycles to avoid stress.

Which Option Suits Large Landowners?

Large landowners with stable income often prefer self finance because:

- They avoid markup

- They maintain liquidity through other assets

- They benefit from cash discounts

Impact of Government Subsidies in 2026

In many cases, tractor subsidy programs require:

- Partial self finance

- Bank involvement for balance payment

This makes a hybrid approach popular—part self finance, part bank lease.

Key Factors to Consider Before Deciding

1. Farm Size

Larger farms generate steady income, supporting self finance.

2. Crop Cycle

Seasonal crops favor installment-based leasing.

3. Income Stability

Uncertain income makes full cash payment risky.

4. Future Expansion Plans

If you plan to expand, preserving cash via leasing is smarter.

5. Risk Tolerance

Leasing carries repayment risk; self finance carries liquidity risk.

Expert Recommendation for 2026

There is no one-size-fits-all answer.

- Choose Self Finance if:

- You have surplus cash

- You want zero debt

- You seek long-term cost savings

- Choose Bank Lease if:

- Cash is limited

- You want modern machinery

- You prefer spreading payments

Conclusion: Self Finance vs Bank Lease for Tractor in 2026

In 2026, the decision between self finance vs bank lease for tractor depends on financial strength, risk appetite, and farming goals. Self finance offers peace of mind and lower costs, while bank leasing provides accessibility and flexibility.

Smart farmers analyze total cost, income stability, and future plans before deciding. In many cases, a balanced mix of self payment and financing delivers the best outcome.

FAQs – Self Finance vs Bank Lease for Tractor

1. Is bank leasing safe for tractors in 2026?

Yes, if installments are planned according to crop income and bank terms are understood.

2. Which option is cheaper overall?

Self finance is cheaper because it involves no interest or markup.

3. Can small farmers buy tractors through banks in 2026?

Yes, most banks offer special agricultural financing for small farmers.

4. Does bank leasing affect tractor resale?

Yes, resale is restricted until all installments are cleared.

5. Can I combine subsidy with bank lease?

Yes, many 2026 schemes allow partial self finance with bank leasing.