Punjab Asan Karobar Finance Loan Phase 2 Required Documents 2025

The Punjab Asan Karobar Finance Loan Phase 2 Required Documents 2025 are the backbone of the application process. Even if you meet the eligibility criteria, your loan cannot be approved without submitting the correct documents. The Punjab government has designed this program to support entrepreneurs and small-to-medium businesses through interest-free loans, but strict documentation is necessary to ensure transparency and fairness.

In this detailed guide, we will explain every single document needed for the Punjab Asan Karobar Finance Loan 2025. Whether you are applying as a new entrepreneur or as an existing business owner, this article will give you complete clarity. The language is kept simple so that even matric-level readers can easily understand.

Why Documents Are Important for Asan Karobar Finance Phase 2

Documents are not just papers; they prove your identity, your business ownership, and your financial credibility. The Punjab Government Asan Karobar Loan Scheme handles large sums of money, and without proper documents, the scheme could be misused.

That is why the CM Punjab Asan Karobar Finance Phase 2 requires applicants to carefully prepare and submit documents that confirm they are genuine business owners, active taxpayers, and residents of Punjab.

Check Also: Maryam Nawaz Flood Relief 2025

Complete List of Punjab Asan Karobar Finance Loan Phase 2 Required Documents 2025

Here is the step-by-step breakdown of all the documents you need:

1. CNIC (Computerized National Identity Card)

- Must be valid (not expired).

- Copy of both front and back sides.

- Ensures applicant’s identity and age (25–55 years requirement).

2. NTN (National Tax Number) Certificate

- A mandatory requirement.

- Proves that you are registered with FBR.

- Without NTN, your application will not be accepted.

3. FBR Active Taxpayer Proof

- Printout from FBR’s Active Taxpayer List (ATL).

- Confirms that you are a current tax filer.

- Important for transparency in the loan scheme.

4. Proof of Residence in Punjab

- Utility bill (electricity, gas, water)

- Rental agreement if you live on rent

- Property ownership papers if you own the house

This ensures that only residents of Punjab can apply.

5. Proof of Business in Punjab

- Rental agreement of shop/factory/office OR

- Ownership deed (registry, allotment letter)

Business must physically exist in Punjab.

6. Business Registration Certificate (If Applicable)

- For registered companies, firms, or partnerships.

- Ensures your business is officially recognized.

7. Bank Statements

- Recent 6–12 months bank statement.

- Shows your financial transactions and business health.

8. Sales Record / Invoices

- Required for small and medium enterprises.

- Proves annual sales volume.

9. Clean Credit History Proof

- Bank clearance certificate OR

- No default letter from financial institution.

10. Photographs

- Passport-size photographs of applicant.

- Used for official records.

Special Documents for Women, Transgender & Differently-Abled Applicants

The Punjab Asan Karobar Finance Loan 2025 has special equity contribution relaxations for these groups. Documents may include:

- Disability certificate (for differently-abled persons)

- Gender recognition CNIC (for transgender applicants)

- Business ownership papers in woman’s name (for women entrepreneurs)

These ensure that the special benefits under CM Punjab Asan Karobar Finance Phase 2 reach the right people.

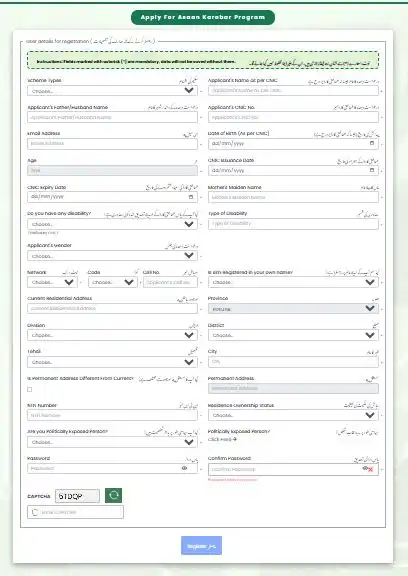

Step-by-Step Guide to Preparing Required Documents

- Check CNIC Expiry: Renew it from NADRA if expired.

- Register as Tax Filer: Apply for NTN and file taxes with FBR.

- Collect Business Papers: Rent agreement, registry, or shop ownership proof.

- Get Bank Statement: Request your bank for an official statement.

- Compile Sales Records: Maintain invoices or receipts.

- Make Copies: Keep at least 2–3 copies of each document.

- Digital Backup: Scan all documents for online submission.

Common Mistakes to Avoid in Document Submission

- Submitting expired CNIC.

- Applying without NTN or not being in Active Taxpayer List.

- Giving fake rental or business ownership papers.

- Incomplete bank statements.

- Forgetting photographs or signatures.

Such mistakes often lead to application rejection, even if you are eligible.

Verification Process of Documents

The government verifies documents before approving loans. The process includes:

- NADRA verification of CNIC.

- FBR cross-check of NTN and tax status.

- Bank verification of statements and credit history.

- On-ground inspection of business premises (if required).

Only after successful verification will the loan be processed.

Benefits of Submitting Complete Required Documents

When you submit all Asan Karobar Finance Phase 2 Documents correctly:

- Your application moves faster.

- You avoid delays or rejection.

- Loan approval chances increase.

- Trust is built between applicant and scheme.

This is why preparing Required Documents for Asan Karobar Loan 2025 is the most important step.

Read Also: Punjab Minority Card Scheme Update 2025

FAQs About Punjab Asan Karobar Finance Loan Phase 2 Required Documents 2025

1. Do I need to be a tax filer for this scheme?

Yes, active FBR tax filer status is compulsory.

2. Can I use my electricity bill as proof of residence?

Yes, utility bills are acceptable as residence proof.

3. Is a bank statement necessary for new businesses?

Yes, even new businesses must show some banking record.

4. Can I apply without a business registration certificate?

If your business is not registered but you have other proofs (rent/ownership papers, sales record), you can still apply.

5. Do women need extra documents?

No, only standard documents plus business ownership papers in their name.

Conclusion

The Punjab Asan Karobar Finance Loan Phase 2 Required Documents 2025 are designed to ensure that genuine applicants benefit from the scheme. From CNIC and NTN to residence and business proofs, every document plays a vital role in the approval process. If you prepare and submit them properly, your loan application will move smoothly.

The Punjab Government Asan Karobar Loan Scheme is a golden chance for entrepreneurs, but only those with complete documents will succeed.

For more detailed guides on government loan schemes and documentation, you can visit gts.com.pk.