FBR Digital Invoice Registration 2025 – Online Apply, Verification & Requirements

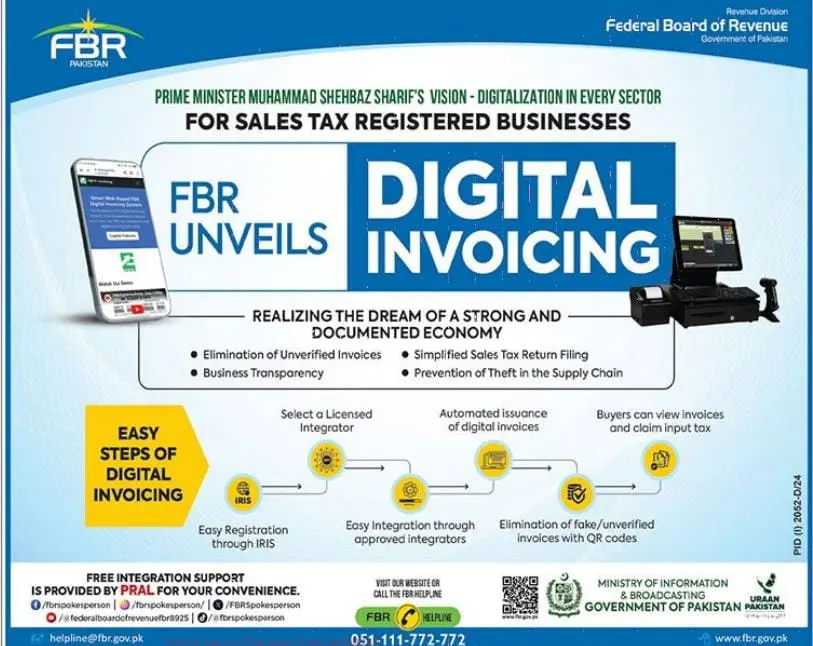

The Federal Board of Revenue (FBR) has officially rolled out the FBR Digital Invoice Registration 2025, a modern taxation system designed to create transparency, eliminate fake invoices, and simplify sales tax compliance. This step marks a huge milestone in Pakistan’s journey towards a digital economy.

Through this system, every sales tax registered business must generate invoices digitally via FBR-approved platforms. These invoices are assigned unique QR codes, allowing customers and FBR to verify transactions instantly. This not only prevents fraud but also strengthens the documentation of the economy.

What is FBR Digital Invoice Registration 2025?

The FBR Digital Invoice Registration is a compulsory mechanism for businesses registered under sales tax laws in Pakistan. Under this system, every sale generates a digital invoice directly integrated with the FBR server.

Key highlights of the system:

- Automated invoice issuance with QR codes.

- Online registration through FBR IRIS portal.

- Real-time verification by buyers and FBR.

- Integration support provided by PRAL (Pakistan Revenue Automation Limited).

This system ensures that invoices cannot be forged, unverified, or misused.

Eligibility Criteria for Digital Invoice Registration

The eligibility criteria for FBR Digital Invoice 2025 are as follows:

- Sales Tax Registered Businesses – Only those businesses registered under the Sales Tax Act are eligible and required to implement this system.

- Designated Sectors – Initially applied to retailers, wholesalers, manufacturers, and service providers notified by FBR.

- Large Businesses – Companies with a higher annual turnover or those already integrated with POS/ERP are prioritized.

- Voluntary Adoption – Small and medium-sized businesses may voluntarily register to improve transparency and compliance.

FBR is gradually expanding the scope, and by the end of 2025, most registered businesses will be covered.

Check Also: GTS YTO Tractor Price in Pakistan 2025

Benefits of FBR Digital Invoice Registration

The system brings multiple advantages to businesses and customers:

- Transparency – Fake and duplicate invoices are eliminated.

- Tax Compliance – Automated reporting makes filing easy.

- Customer Trust – Buyers can verify invoices instantly with QR codes.

- Fraud Prevention – Reduces invoice manipulation and tax evasion.

- Simplified Returns – Sales tax returns become faster and more accurate.

- Ease of Verification – Both FBR and customers can check invoice authenticity in real-time.

Online Apply Process – How to Register

The online apply process for FBR Digital Invoice Registration 2025 is simple and user-friendly:

Step 1 – Log in to IRIS Portal

- Visit the official FBR IRIS Portal.

- Use your sales tax registration credentials to log in.

Step 2 – Select Digital Invoicing Option

- From the main dashboard, select “Digital Invoicing Registration.”

- Choose your business category (Retailer, Manufacturer, Service Provider, etc.).

Step 3 – Choose Licensed Integrator

- FBR provides a list of approved licensed integrators.

- Select an integrator to link your POS/ERP with FBR’s system.

Step 4 – System Integration

- Integrate your POS system, ERP, or billing software with FBR’s portal.

- PRAL provides free support for integration.

Step 5 – Start Issuing Digital Invoices

- Once approved, every transaction will automatically generate a digital invoice with a QR code.

Invoice Verification Process

Customers and businesses can verify digital invoices through these methods:

- QR Code Scanning – Each invoice has a QR code. Buyers can scan it with their smartphone to confirm authenticity.

- FBR Verification Portal – Enter the invoice number on the FBR verification system online.

- FBR Mobile App – Download FBR’s official app to check invoice details anytime.

This makes the process secure, transparent, and customer-friendly.

Check Alos: GTS Massey Ferguson Tractors Price List 2025

Requirements for FBR Digital Invoice 2025

Before applying for registration, businesses must fulfill the following requirements:

- Sales Tax Registration – Only registered taxpayers can apply.

- Valid NTN (National Tax Number) – Your NTN must be active.

- Business Bank Account – Required for proper documentation.

- POS/ERP System – Businesses must have a billing system to integrate with FBR.

- Internet Connectivity – Stable internet connection is essential for real-time reporting.

Integration Guide for Businesses

There are three major ways businesses can integrate with the FBR Digital Invoicing 2025 system:

- Direct POS Integration – Retailers with modern POS machines connect directly with FBR servers.

- ERP Software Integration – Large businesses can integrate their ERP system for automated reporting.

- Cloud-Based Integrators – Small businesses can choose cloud invoicing systems already approved by FBR.

Integration ensures that invoices are automatically transmitted to FBR in real-time.

Challenges Businesses May Face

Despite its benefits, businesses may face some challenges:

- Cost of upgrading POS/ERP systems.

- Training staff to use the new system.

- Connectivity issues in underdeveloped areas.

- Initial resistance to change from manual invoicing.

However, the government provides free integration support via PRAL to make adoption smoother.

Future of Digital Invoicing in Pakistan

The FBR Digital Invoice Registration 2025 is a step towards building a documented and cashless economy. By reducing corruption, improving compliance, and boosting government revenue, it will benefit Pakistan’s economic system in the long run.

The future goal is to integrate all small, medium, and large businesses into a fully automated tax system where every sale is digitally recorded and verified.

FAQs about FBR Digital Invoicing System Pakistan:

Q1. Is FBR Digital Invoice Registration mandatory in 2025?

Yes, for all sales tax registered businesses notified by FBR.

Q2. How can customers verify invoices?

Customers can scan the QR code or check via the FBR app/website.

Q3. Do small businesses need to register?

Not compulsory for all, but voluntary registration is encouraged.

Q4. Is there any fee for applying?

No official fee, but businesses may incur POS/ERP integration costs.

Q5. Can I register online without visiting FBR?

Yes, the entire process is online through the IRIS portal.

Conclusion – FBR Digital Invoice Registration 2025

The FBR Digital Invoice Registration 2025 is a revolutionary system for ensuring tax transparency in Pakistan. It simplifies compliance for businesses, prevents tax evasion, and builds customer trust through verified invoices.

If you are a sales tax registered business, you must complete your registration and integration as soon as possible. By adopting digital invoicing, you not only stay compliant with FBR regulations but also contribute to a stronger, documented economy in Pakistan.

FBR Digital Invoice Registration 2025