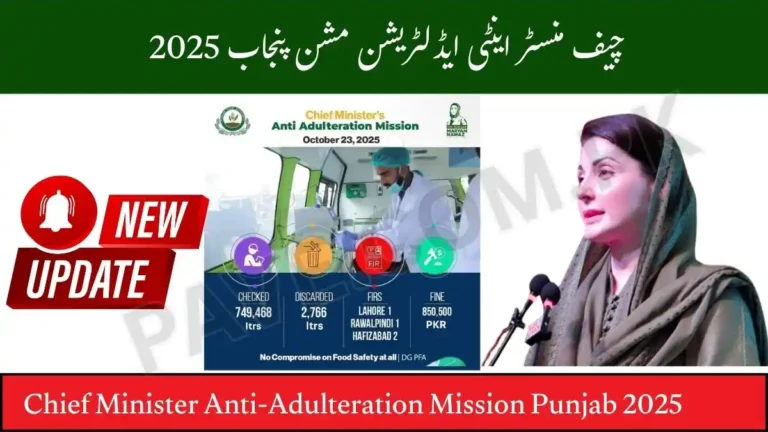

Updated: CM Asaan Karobar Finance Loan Phase 2 Eligibility 2025 – Who Can Apply & How to Qualify Easily

The Punjab government has once again taken a big step to support small and medium businesses by introducing the CM Asaan Karobar Finance Loan Phase 2 Eligibility program. This scheme is specially designed for people who want to start or expand their business but face financial challenges. The most important part of this scheme is who can apply — in simple words, the eligibility criteria.

Many people have questions: Am I eligible? What age limit is required? Do I need to be a tax filer? Can women and differently-abled persons also apply? In this article, we will give you a complete and easy guide to CM Punjab Loan Eligibility 2025, explained in simple words.

Why Eligibility Matters in Asan Karobar Finance Phase 2

The Punjab government is providing interest-free loans of up to 30 million PKR. To ensure the loans reach genuine business owners and serious entrepreneurs, eligibility conditions are applied. Without these criteria, the scheme could be misused.

By understanding the CM Asaan Karobar Finance Loan Phase 2 Eligibility, you will know clearly whether you qualify or not. This saves time, increases your chances of approval, and helps you prepare the right documents.

Detailed Eligibility Criteria for CM Asaan Karobar Finance Loan Phase 2

1. Business Type and Size

The scheme focuses on Small and Medium Enterprises (SMEs). This means:

- Small Enterprises: Annual sales up to PKR 150 million

- Medium Enterprises: Annual sales between PKR 150 million – PKR 800 million

👉 If your business sales are above 800 million, you will not be eligible under this program.

2. Age Limit

Applicants must be between 25 to 55 years old.

- If you are younger than 25, you are not eligible.

- If you are older than 55, you also cannot apply.

This range ensures that applicants are mature, experienced, and able to manage the repayment responsibly.

3. Tax Filer Requirement

Only active FBR tax filers can apply.

- You must have a valid NTN (National Tax Number).

- Your name should be in the Active Taxpayer List (ATL) of FBR.

This condition is included to encourage tax culture in Pakistan. If you are not a filer yet, you must register before applying.

4. Clean Credit History

Your financial record must be clear.

- No previous bank loan defaults

- No bounced cheques

- No overdue payments on financial records

👉 If your credit history is weak, your application will be rejected even if you meet other eligibility conditions.

5. Punjab Residency Requirement

Both your residence and business must be located in Punjab.

- You must provide proof of residence (utility bill, rental agreement, or ownership papers).

- Your business must also operate from Punjab.

This is because the scheme is only for Punjab citizens.

6. Valid CNIC and NTN

You must have a valid CNIC issued by NADRA.

- Expired CNIC will not be accepted.

- You must also have a valid NTN for tax purposes.

7. Business Premises Ownership / Rent

If you already have a business, you must either:

- Own the shop, factory, or office, OR

- Have a legal rental agreement

Without proof of premises, you are not considered eligible

Read Also: Latest Update: CM Punjab Green Tractor Scheme 2025 Winners List

Special Relaxations in Eligibility

The government has introduced special equity relaxation for certain groups to promote inclusivity:

- Women Entrepreneurs: Only 10% equity contribution is required instead of 20%.

- Transgender Persons: Same relaxation as women (10% contribution).

- Differently-Abled Persons: Also eligible with just 10% contribution.

This means that these groups get easier access to loans compared to others.

Documents Required to Prove Eligibility

When applying for Asan Karobar Business Loan Scheme, you must submit documents that prove you meet eligibility conditions:

- Copy of CNIC

- NTN Certificate

- Proof of FBR tax filer status

- Proof of residence in Punjab

- Proof of business in Punjab (rent agreement or ownership papers)

- If you are an existing business owner: Business registration certificate, sales record, and bank statement

👉 Missing documents can cause rejection even if you are otherwise eligible.

Common Reasons for Rejection of Eligibility Applications

Many people fail to qualify because they ignore small details. Here are the top mistakes to avoid:

- Not being a tax filer → register with FBR before applying.

- Providing fake or expired documents → CNIC must be valid.

- Business outside Punjab → only Punjab-based businesses qualify.

- Weak credit history → unpaid bank loans or dishonored cheques.

- Age limit violation → under 25 or over 55 are automatically rejected.

If you avoid these mistakes, your chance of approval increases.

Benefits of Meeting the Eligibility Criteria

Once you are eligible, you can enjoy many benefits:

- Interest-free loans (0% markup)

- Loan amounts from PKR 1 million to 30 million

- Grace period of up to 6 months for startups

- Equal monthly installment repayment system

- Opportunity to expand your business without financial burden

This shows why fulfilling the CM Asaan Karobar Finance Loan Phase 2 Eligibility is so important.

How to Strengthen Your Application for CM Asaan Karobar Finance Loan Phase 2 Eligibility

Even if you meet all the basic eligibility requirements, your application can still be rejected due to weak documentation or presentation. To make your case stronger, applicants should prepare a simple but convincing business plan before applying.

It should include your product or service description, target market, estimated costs, and profit projection. You should also attach bank statements, tax records, and any previous business performance documents to show financial responsibility. Those applying for startups can include a letter of intent or prototype proof.

These small but professional steps demonstrate seriousness and reliability, significantly improving approval chances under the CM Asaan Karobar Finance Loan Phase 2 Eligibility guidelines.

Read Also: Top 5 High Power Tractors in Pakistan 2025

FAQs About AKF Asaan Karobar Program 2025 Eligibility

1. Can a 23-year-old apply for this scheme?

No, the minimum age is 25 years.

2. Do I need to be a tax filer to apply?

Yes, only active FBR tax filers are eligible.

3. Can I apply if my business is in Sindh but I live in Punjab?

No, both your residence and business must be in Punjab.

4. Are women given special relaxation in eligibility?

Yes, women only need 10% equity contribution compared to 20% for men.

5. Can I apply if my CNIC is expired?

No, your CNIC must be valid at the time of application.

How can I increase my chances of loan approval under this scheme?

To increase approval chances, make sure your documents are updated, your FBR tax status is active, and your business plan clearly explains how funds will be used. Attach supporting records like invoices, registration certificates, and bank statements to show credibility.

Can fresh graduates or first-time entrepreneurs apply for the CM Asaan Karobar Finance Loan Phase 2?

Yes, fresh graduates and new entrepreneurs can apply as long as they meet the age and filer requirements. However, they should submit a business feasibility plan to show realistic goals and repayment capacity.

Conclusion

The CM Asaan Karobar Finance Loan Phase 2 Eligibility criteria are clear and strict to ensure that only genuine and deserving entrepreneurs benefit. If you are between 25–55 years old, a registered tax filer, living and doing business in Punjab, and have a clean financial history, you are eligible. Women, transgender, and differently-abled persons have even easier access under special relaxations.

This scheme under the Punjab Government Loan Scheme 2025 is a golden chance to start or expand your business without worrying about interest rates.

For more guides and updates on business loans and government schemes, visit gts.com.pk and stay informed.