Can Loan Defaulters Apply for Green Tractor Scheme 2026 Phase 3? Complete Guide

Green Tractor Scheme 2026 Phase 3 has become one of the most discussed agricultural support programs in Pakistan, especially among farmers who have faced financial difficulties in the past.

One of the most searched and confusing questions right now is whether loan defaulters are allowed to apply under this scheme or not. Many farmers hesitate to apply because of past loan issues, incomplete repayments, or misunderstandings about eligibility rules. This guide explains everything clearly, practically, and honestly so you can decide with confidence.

Understanding Green Tractor Scheme Phase 3 In 2026

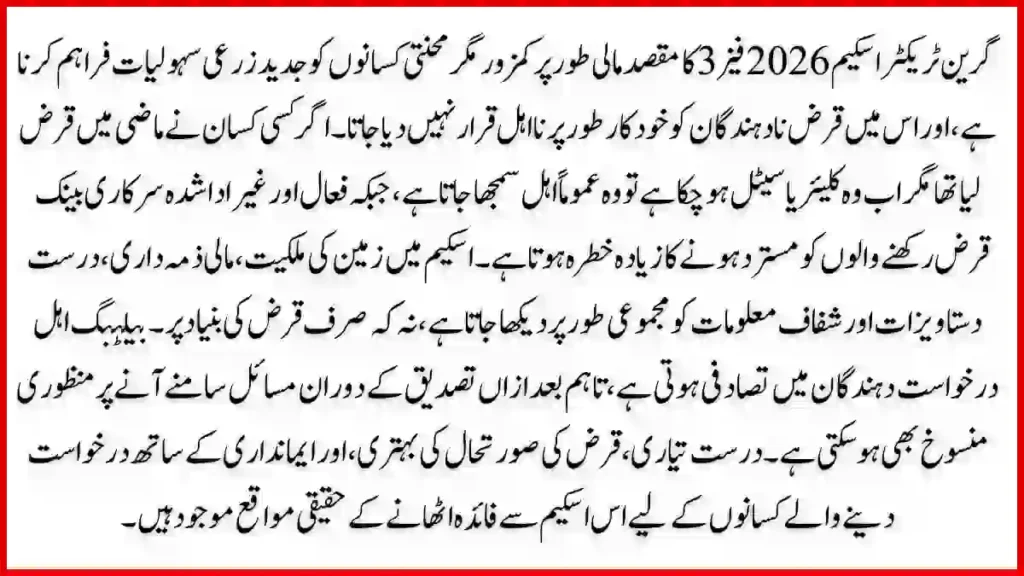

The Green Tractor Scheme 2026 Phase 3 is a government-backed initiative designed to help farmers modernize agriculture through subsidized tractors. The core objective is to improve productivity, reduce manual labor, and support small to medium landholding farmers.

This phase focuses more on transparency, digital verification, and financial discipline compared to previous versions of the scheme. Applications, verification, and balloting are now mostly handled through official systems linked with land records and financial data.

Farmers across Punjab are actively searching for updates related to eligibility, especially those who previously faced loan-related issues under banks or agricultural financing programs.

Why Loan Defaulters Are Concerned About Eligibility

Loan defaulters often assume they are automatically disqualified from all government schemes. This fear is not entirely baseless, but it is also not always accurate. Under the Green Tractor Scheme Pakistan, financial history is reviewed, but it is not the only deciding factor.

Many farmers became defaulters due to crop loss, floods, market instability, or delayed payments from buyers. The government understands these realities and has introduced conditional eligibility rules rather than blanket bans.

This is why understanding loan defaulter eligibility correctly is critical before deciding not to apply.

Official Position On Loan Defaulters In Phase 3

Under the Green Tractor Scheme 2026 Phase 3, loan defaulters are not automatically rejected at the application stage. However, eligibility depends on the nature, status, and resolution of the default.

There are three broad categories considered during evaluation:

Farmers With Cleared Or Settled Loans

If a farmer was previously a defaulter but has since cleared the outstanding loan or reached an official settlement with the bank, they are usually treated as eligible. Proof of clearance or settlement is required during verification.

Farmers With Active Default Status

Applicants with active, unresolved defaults with agricultural banks or government-backed loan programs face higher rejection risk. This is because the scheme aims to support financially responsible beneficiaries.

Farmers With Non-Bank Or Private Defaults

In many cases, defaults with private individuals or informal lenders are not part of official financial records. These do not usually impact eligibility unless linked to registered institutions.

This balanced approach allows many farmer loan defaulter cases to still qualify under certain conditions.

How Financial Verification Is Conducted

Financial verification is a key step in the application process. During Phase 3, authorities cross-check applicant data with:

- Agricultural bank loan records

- Government-backed credit schemes

- CNIC-linked financial history (limited scope)

The purpose is not punishment but risk management. The tractor scheme rules aim to ensure that subsidized tractors go to farmers who can maintain and utilize them properly.

Applicants are not required to submit bank statements upfront, but discrepancies may trigger additional verification.

Difference Between Rejection And Conditional Approval

A common misunderstanding is that loan defaulters are instantly rejected. In reality, many cases fall under conditional approval.

Conditional approval means:

- Application is accepted initially

- Additional documents are requested

- Clearance proof may be required

- Final approval depends on compliance

This system was introduced to make the tractor scheme 2026 update more inclusive while maintaining accountability.

Role Of CM Tractor Scheme In Policy Flexibility

The CM Tractor Scheme operates under broader agricultural reform goals. Provincial authorities have discretionary powers to adjust criteria based on economic conditions, farmer distress levels, and disaster impact.

In recent years, relief-focused policies have allowed flexibility for farmers affected by floods, droughts, or crop disease. This is why Phase 3 includes review mechanisms instead of rigid exclusions.

This approach strengthens trust between farmers and the state while protecting public funds.

Land Ownership And Loan Status Relationship

Loan status alone does not decide eligibility. Land ownership plays an equally important role. Applicants must show valid land records through official systems.

In many cases, a farmer with clear land ownership but past loan issues may be preferred over someone with unclear land records. This balance ensures fairness within green tractor phase 3 selection.

Joint ownership, inherited land, and leased land cases are assessed individually.

Tractor Subsidy Amount And Financial Responsibility

The tractor subsidy Pakistan program offers significant financial support, sometimes covering a large portion of the tractor’s cost. Because public money is involved, authorities assess whether the applicant can manage remaining payments, maintenance, and usage.

This is where loan history becomes relevant—not as punishment, but as a financial risk indicator.

Applicants who demonstrate improved financial discipline, stable farming income, or cleared dues are viewed more positively.

Common Reasons Loan Defaulters Get Rejected

Understanding rejection reasons can help avoid mistakes. Common issues include:

- Active unpaid loans with government-backed banks

- Fake or incomplete clearance certificates

- Mismatch between CNIC and bank records

- False declarations in application forms

Many rejections could be avoided with accurate documentation and honesty during the application process.

How Loan Defaulters Can Improve Approval Chances

Loan defaulters who want to apply under Green Tractor Scheme 2026 Phase 3 should take proactive steps before applying.

Clear Or Settle Outstanding Loans

Even partial settlements officially recorded can significantly improve eligibility chances.

Obtain Written Clearance Or Status Letters

Banks can issue loan status letters showing repayment progress or settlement agreements.

Avoid False Information

Incorrect declarations often lead to permanent rejection across multiple schemes.

Apply With Correct Land Records

Ensure land ownership details are updated and verified before submission.

Misconceptions About Loan Defaulters And Tractor Schemes

Many myths circulate on social media and local communities. Some common misconceptions include:

- All defaulters are banned for life

- Private loan issues affect government schemes

- Rejection means permanent disqualification

- Only rich farmers get approved

None of these are fully true. The scheme uses a balanced, data-driven approach rather than assumptions.

Balloting Process And Loan Status Impact

The balloting system is random among eligible applicants. Loan status does not influence balloting once eligibility is confirmed.

However, verification continues after balloting. If financial discrepancies appear later, approval can still be withdrawn. This two-stage system ensures fairness and accountability.

What To Do If A Loan Defaulter Is Rejected

Rejection does not always mean the end. Applicants can:

- File an appeal with updated documents

- Clear outstanding dues and reapply in future phases

- Seek clarification from agriculture offices

Future phases may introduce revised criteria based on policy outcomes.

FAQs About Can Loan Defaulters Apply for Green Tractor Scheme 2026 Phase 3?

Can a loan defaulter apply for the Green Tractor Scheme in 2026?

Yes, loan defaulters can apply, but approval depends on loan status, settlement proof, and verification results.

Does bank loan default mean automatic rejection?

No, automatic rejection does not apply in all cases. Cleared or settled loans are usually acceptable.

Are private loan defaults considered?

Private or informal loan defaults are generally not part of official verification unless linked to registered institutions.

Can rejected applicants apply again?

Yes, farmers can reapply in future phases after resolving rejection causes.

Is land ownership more important than loan history?

Both are important, but verified land ownership often carries significant weight in eligibility decisions.

Conclusion

The Green Tractor Scheme 2026 Phase 3 is not designed to exclude struggling farmers but to support responsible agricultural growth. Loan defaulters should not assume disqualification without understanding the actual rules. The scheme evaluates applicants holistically, considering land ownership, financial behavior, and documentation accuracy.

Farmers who take corrective steps, maintain transparency, and understand the process have a realistic chance of approval. Instead of relying on rumors, informed preparation is the key to benefiting from this important agricultural initiative.