Green Tractor Scheme vs Private Tractor Loan – Which Is Better for Farmers?

Green Tractor Scheme Vs Private Tractor Loan is one of the most discussed topics among farmers today who are planning to buy a new tractor but feel confused about financing options. Choosing the right path can directly affect farm productivity, financial stability, and long-term growth.

Understanding Tractor Financing for Farmers

Buying a tractor is a major investment for any farmer. It is not just a machine; it becomes the backbone of daily agricultural operations. From land preparation to harvesting, tractors play a vital role in reducing labor costs and increasing efficiency. However, due to rising tractor prices, most farmers rely on financing options rather than full upfront payment.

Today, farmers usually choose between government-supported schemes and private financing solutions. This choice often creates confusion because both options come with advantages and limitations. Making the wrong decision can lead to financial pressure, delayed repayments, or limited flexibility.

This is where a clear Farmer Finance Comparison becomes essential. Understanding how each option works, who it benefits the most, and what hidden factors exist helps farmers make confident decisions.

What Is the Green Tractor Scheme?

The CM Punjab Green Tractor Scheme is a government-backed initiative designed to support small and medium-scale farmers. Its primary goal is to make tractors affordable by offering subsidies and easier payment terms. These schemes are usually introduced to improve agricultural productivity and support rural development.

Under this scheme, eligible farmers receive financial assistance that reduces the overall cost of the tractor. The subsidy amount depends on various factors such as landholding size, income category, and regional policies.

Key Features of the Green Tractor Scheme

The Green Tractor Scheme focuses on affordability and accessibility. It targets farmers who may not qualify for traditional loans or who struggle with high-interest financing.

Some key highlights include:

- Partial government subsidy on tractor cost

- Lower financial burden compared to market loans

- Designed mainly for small and marginal farmers

- Often includes eligibility conditions and documentation requirements

However, availability is usually limited to specific regions and time periods. Farmers often need to apply during announced windows and meet strict criteria.

What Is a Private Tractor Loan?

A private tractor loan is offered by banks, NBFCs, and private financial institutions. These loans work like standard vehicle loans and allow farmers to purchase tractors with flexible repayment plans.

A Bank Tractor Loan is typically easier to access for farmers with proper documentation and credit history. Private loans are not limited by government schedules and can be processed quickly.

Key Features of Private Tractor Loans

Private tractor loans focus on speed, flexibility, and wider accessibility.

Common features include:

- Faster approval process

- Flexible loan tenure options

- Available throughout the year

- Less dependency on government approvals

Although interest rates are higher than subsidized schemes, farmers benefit from immediate access and wider tractor model choices.

Green Tractor Scheme Vs Private Tractor Loan: Core Differences

Understanding the real difference between government support and private financing helps farmers avoid costly mistakes. Green Tractor Scheme Vs Private Tractor Loan decisions should always be based on personal financial capacity, urgency, and eligibility.

Comparison Table: Scheme vs Loan

| Feature | Green Tractor Scheme | Private Tractor Loan |

|---|---|---|

| Financial Support | Government subsidy | Full loan amount |

| Interest Rate | Very low or none | Market-based interest |

| Availability | Limited timeframes | Year-round |

| Approval Speed | Slower | Faster |

| Eligibility | Strict criteria | Flexible |

This Subsidy Vs Loan comparison highlights how each option serves different farmer needs.

Cost Impact on Farmers

The total cost of owning a tractor goes beyond the showroom price. Maintenance, insurance, fuel, and loan repayment all contribute to the long-term expense.

A Tractor Cost Comparison shows that while subsidized tractors appear cheaper initially, private loans offer flexibility that can reduce indirect costs such as delays and missed seasons.

Long-Term Cost Breakdown

| Cost Factor | Green Scheme | Private Loan |

|---|---|---|

| Initial Payment | Lower | Moderate |

| Interest Expense | Minimal | Higher |

| Delay Cost | Possible | None |

| Model Choice | Limited | Wide |

Farmers should assess both visible and hidden costs before deciding.

Eligibility and Documentation Differences

Eligibility plays a major role when choosing between options. Green Tractor Scheme Vs Private Tractor Loan choices often depend on whether a farmer qualifies for government support.

Government schemes usually require land records, income proof, residency certificates, and prior registration. On the other hand, private loans mainly focus on identity documents, land ownership, and repayment capacity.

This difference is a crucial part of Government Vs Private Loan evaluation.

Flexibility and Freedom of Choice

Private tractor loans offer more freedom in selecting brands, models, and dealers. Farmers can choose tractors based on horsepower needs and modern features without restriction.

Government schemes may restrict options to approved manufacturers or specific models. While this helps standardization, it limits customization.

For farmers seeking the Best Tractor Option, flexibility often outweighs lower upfront costs.

Risk Factors Farmers Should Consider

Every financing option carries risks. Delays in subsidy disbursement, limited application windows, or rejection after approval can affect government schemes.

Private loans involve interest risks, but timely repayments build credit history and improve future financing options. This balance is important in Agriculture Financing decisions.

When the Green Tractor Scheme Is the Better Choice

The Green Tractor Scheme is ideal for:

- Small and marginal farmers

- Farmers with limited income

- Those not in urgent need of a tractor

- Farmers who qualify for subsidies

In such cases, Green Tractor Scheme Vs Private Tractor Loan analysis often favors government support due to reduced financial stress.

When a Private Tractor Loan Makes More Sense

Private loans are better suited for:

- Farmers needing immediate machinery

- Commercial or large-scale farmers

- Those seeking premium tractor models

- Farmers comfortable with EMI payments

Here, speed and flexibility outweigh subsidy benefits in Green Tractor Scheme Vs Private Tractor Loan decisions.

FAQs

Is the Green Tractor Scheme available in every state?

No, availability depends on state government policies and budget allocations.

Can I apply for both options at the same time?

Usually no. Farmers must choose one financing method per purchase.

Do private tractor loans require collateral?

In most cases, the tractor itself serves as collateral.

Which option has lower long-term financial pressure?

Government schemes usually reduce long-term burden, but only if there are no delays.

How do I choose the right option?

Consider urgency, eligibility, financial stability, and tractor requirements.

Conclusion

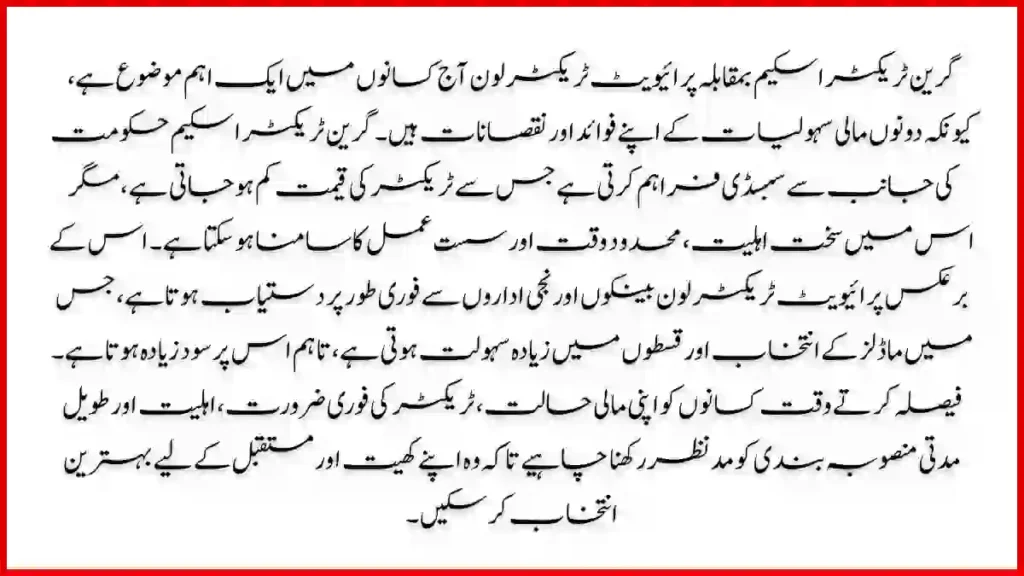

Choosing between Green Tractor Scheme Vs Private Tractor Loan is not about which option is universally better, but which one fits a farmer’s individual needs. Government schemes reduce costs and support small farmers, while private loans offer speed, flexibility, and wider choices.

By carefully evaluating financial capacity, urgency, and long-term goals, farmers can make informed decisions that support sustainable agricultural growth and financial security.